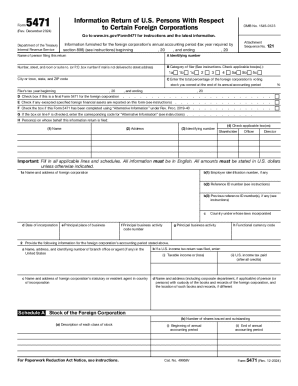

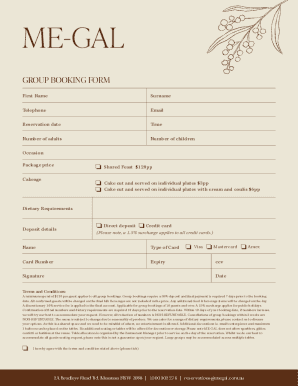

IRS 5471 2025-2026 free printable template

Instructions and Help about IRS 5471

How to edit IRS 5471

How to fill out IRS 5471

Latest updates to IRS 5471

All You Need to Know About IRS 5471

What is IRS 5471?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

FAQ about IRS 5471

What should I do if I realize I've made an error on my IRS 5471 form?

If you discover an error after filing your IRS 5471, you should amend your form. To do this, submit a corrected IRS 5471 along with an explanation of the changes. Be sure to clearly indicate the revisions made to avoid any confusion during processing.

How can I track the status of my submitted IRS 5471?

To track your IRS 5471 submission, you can check the status through the IRS online portal or contact the IRS directly. Keep a record of your submission date, as that will help in determining the progress and any potential issues that may arise.

Are there special considerations for nonresidents filing IRS 5471?

Yes, nonresidents need to adhere to specific guidelines when filing IRS 5471. They should be aware of their status as foreign entities or individuals and ensure they comply with U.S. tax laws, including any required documentation and potential exemptions applicable to their situation.

What are common errors I should avoid when filing IRS 5471?

Common errors when filing IRS 5471 include incorrect entity classification, failing to report foreign bank accounts, or providing inconsistent information across forms. To minimize mistakes, double-check your entries and consider consulting tax software designed for IRS compliance.