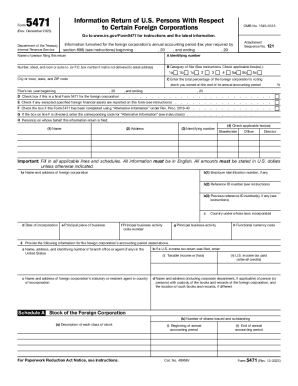

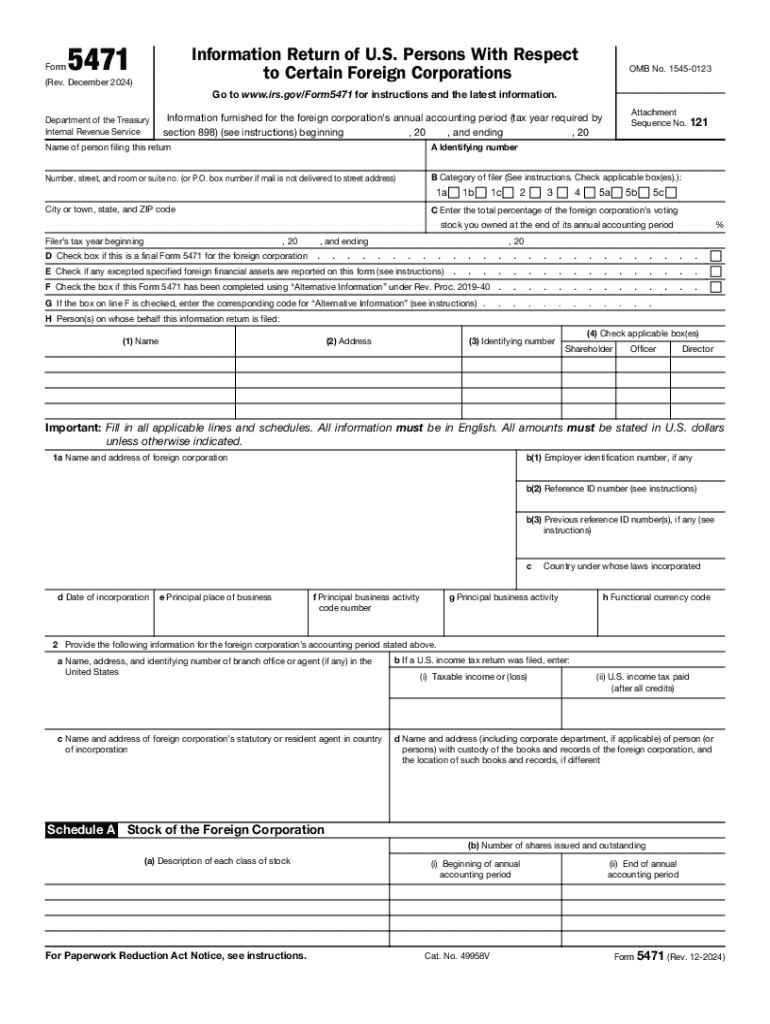

IRS 5471 2024-2025 free printable template

Instructions and Help about IRS 5471

How to edit IRS 5471

How to fill out IRS 5471

Latest updates to IRS 5471

All You Need to Know About IRS 5471

What is IRS 5471?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 5471

What should I do if I realize I've made a mistake on my IRS 5471 after submitting it?

If you discover a mistake on your IRS 5471 after submission, you should go ahead and file an amended version of the form. It’s crucial to include a detailed explanation of the corrections made. Be mindful of maintaining documentation to support your amendments in case of future inquiries.

How can I verify if my IRS 5471 submission has been received by the IRS?

To check the status of your IRS 5471 submission, you can contact the IRS directly or use their online tools, if available. It’s crucial to keep your submission confirmation or any relevant tracking numbers for reference to facilitate this process.

What are some common errors that filers make when submitting IRS 5471?

Common errors include incorrect taxpayer identification numbers, failing to report all required foreign entities, and not adhering to the format of the required disclosures. To avoid these mistakes, ensure you thoroughly review the form and consult IRS instructions before submission.

Can I e-file my IRS 5471, and are there any associated service fees?

Yes, you can e-file your IRS 5471, but ensure that your software supports this form. Some service providers may charge a fee for electronic submissions, so it's wise to compare options before selecting an e-filing service.

What should I do if I receive a notice from the IRS regarding my IRS 5471?

If you receive an IRS notice concerning your IRS 5471, first read the notice carefully to understand the issue. Respond promptly, providing any requested information or corrections, and retain a copy of all correspondence for your records.